PayPal is accepted as a form of payment with more online retailers than any other online payment service. However, you can use PayPal for far more than just buying things online. You can run your own business receiving and sending PayPal payments, organize group fundraising, donate to charities, and much more.

Sending Payments

Most people do sign up for a PayPal account just for the ability to buy things online. You can use the PayPal payment system for any of the following activities:

Buying products from online retailersPaying freelancers for their servicesPay for products in-store by connecting your PayPal account with Google Pay or Samsung PaySend money to your family or friends

You’ll notice as you shop across the internet that the Paypal logo is getting to be just as omnipresent as VISA and Mastercard logos. This makes having a PayPal account more useful than ever.

Selecting to pay online through PayPal requires a quick login into your account. Once you finish confirming payment in your account, you’ll get redirected back to the merchant site to finish off the purchase. Making payments to other Paypal users is even easier. In your Paypal account, click the Send button to initiate a payment.

You’ll have the option to choose the payment type — to a friend or paying for a service. If you send money to a friend, the transfer is free. If you pay for a service or product, the seller pays the transfer fee. The company also makes it easy to receive payments via your own custom PayPal URL. To learn how to set one up, check out our article on how to create a PayPal.me address.

Receiving Payments

Receiving payments via Paypal is just as easy as sending them. If you’re receiving it as a friend, you have no fee to worry about. However, if you’re a freelancer or selling products (on eBay, for example), you’ll need to be prepared to pay the usual PayPal transaction fee. You’ll see this fee in your transaction details, along with the option to print the payment invoice and a button to refund the payment if you need to.

There are a few ways you can streamline the process of receiving payments with PayPal. You can create and issue invoices directly from your PayPal account rather than using some third-party invoicing service.

Creating an Invoice

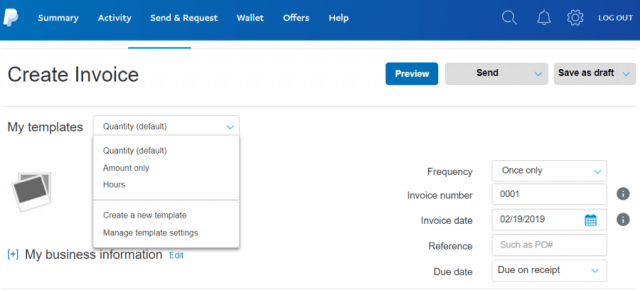

To create an invoice in PayPal, log into your account, click the More icon, and click Create an invoice. PayPal makes it easy to quickly create an invoice that includes many items as you need to add.

Once you’ve populated the invoice, click on the Send button to deliver it to any email address you want. If you want to build your invoice throughout the month, you can keep clicking Save as draft until you’re ready to send it. Ideally, you’ll want to make sure the person you’re sending the invoice to has a Paypal account. Otherwise, they’ll need to create a new one.

Website Payment Buttons

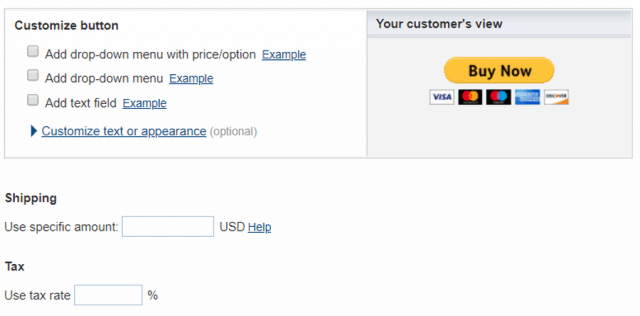

If you’re really serious about using PayPal for your business, you’ll want to add PayPal buttons to your website. PayPal provides you with the tools you need to create a button that’ll fit right into your page. To get started, scroll down the main page and click the Manage Buttons link on the right side of the page. There you’ll see a list of any buttons you’ve already created. Click the Create new button link on the right.

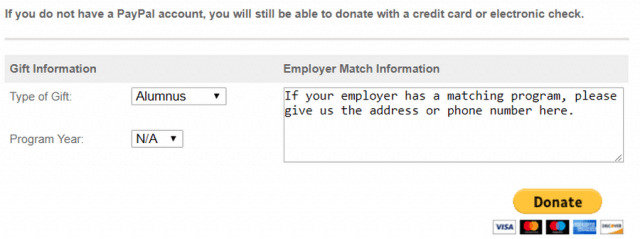

In just three steps, PayPal will walk you through the process of customizing your Buy Now button. You’ll include the price, how the button will behave, shipping and tax costs, and more. There are several types of web button styles available to choose from, including:

Shopping CartBuy NowDonationsSubscriptionsAutomatic BillingInstallment Plan

Depending on the type of button you choose, the customization options change. Once you’re done, you need to copy the embed code and paste it into your website wherever you’d like it to go.

These buttons are perfect for selling products on your site, accepting charitable donations, or any other reason you may want to accept payments on your own site.

Monitoring Your Account

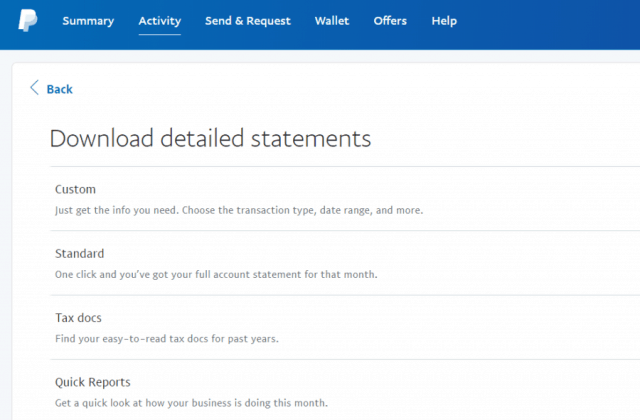

PayPal provides you with plenty of options for keeping track of transactions, including searching back through your transaction history. This especially comes in handy during tax time when you need a full record of all of your business transactions throughout the year. The main summary page gives you a quick overview of your most recent transactions. To dig deeper, click on the Activity link in the menu. Then, click on the Statements button in the upper right corner of the page.

Here, you can access different formats for viewing the history in your account.

Custom: Lets you view a date range or filter by incoming or outgoing fundsStandard: View your entire account historyTax Docs: See only the data you need for your tax recordsQuick Reports: Get a quick overview of your past month’s transactions

If you use PayPal for all your business transactions, these reports give you access to all of the financial records you need to track everything.

Other Things You Can Do

PayPal has adapted through the years to become a perfect financial transaction tool for multiple purposes. It’s much more than just receiving payments or buying things. PayPal offers all of the following features as well:

Donating to a charity: PayPal provides a search engine for a large list of charities you can donate to directly from your account.Create a money pool: Want to pool together funds with friends? Just create a money pool from your PayPal account and invite your friends to contribute by email.Send a gift: Use PayPal’s Send a Gift form to send a financial gift to anyone using their email or mobile number.Split a bill: If you’re renting with roommates and need to split a bill, request money from multiple email accounts and pay the bill in total will all of the contributed funds.

Fees: What to Expect

PayPal offers a fairly inexpensive fee structure, depending on how you use the service. If you make payments from your PayPal account to anyone in the U.S. from your PayPal account, there is no fee at all. To any other country, you’ll need to pay a fixed fee (see below). If you’re funding the payment from a credit card, you’ll need to pay a 2.9% transaction fee, plus a regular fixed fee depending on the sum of the payment.

$0.00-$49.99: You pay 99 cents per transaction$50.00-$99.99: The fee jumps to $2.99$100.00+: You’ll pay $2.99 for payments to Canada or Europe and $4.99 to any other country

Even for substantial transactions, using PayPal can be more affordable than nearly any other financial payment service out there.

Using PayPal

Through the years, PayPal has developed into one of the most important financial services online. Many other services attempt to compete by offering similar services, but few are integrated with so many online marketers as PayPal is. If you’ve never used PayPal, it may be worth your time to give it a try. You can transfer to and from your bank account for free, and it makes paying for things about as convenient and simple as it could be.

![]()