What is Zelle, and Who Owns it?

Launched in mid-2017, Zelle actually got its start in 2011 as clearXchange. At the time, the service offered payment services through member financial institutions and a website. As clearXchange, the service was owned by Bank of America, JP Morgan Chase, and Wells Fargo. Capital One and US Bank eventually joined as partners. In 2016, clearXchange was sold to Early Warning Services. A year later, all clearXchange accounts for person-to-person payment services were rebranded as Zelle. The top 7 financial institutions in the US (Bank of America, JP Morgan Chase, Wells Fargo, US Bank, PNC, CaptialOne, BB&T) still maintain ownership and oversight of Zelle.

How to Send Money With Zelle

There are two ways to get started with Zelle: through a Zelle-participating U.S. financial institution/bank or the official Zelle app. Transactions made through the former are typically done through a website or individual banking app. How you use Zelle determines how quickly you or your recipient gets paid and your spending limits. Regardless of how they’re initiated, Zelle transactions are made between registered Zelle users through a preferred email address or mobile number of a trusted recipient. Unlike some similar services, Zelle transactions move money directly between bank accounts. Consumers don’t need a separate funding account to use the service.

Uses

Zelle is ideal for sending cash to friends, family, and other people you know and trust. Example uses include paying for dinner or monthly rent, shopping at your local market, making Craigslist purchases, and more.

How quickly does Zelle deliver the cash?

Under normal circumstances, transactions between registered Zelle users are instantaneous. If you attempt to send money to a non-member, Zelle will ask the unregistered user (either through email or text) to create a free account to complete the transaction.

Costs

At this time, Zelle doesn’t charge a fee to send or receive money. It recommends, however, confirming with your bank or credit union that there are no additional fees.

Limitations

Not all accounts are eligible to use with Zelle, including credit cards, international debit cards, or international deposit accounts. Checking accounts must be based in the United States.

What About Security?

Zelle, like other online services, is often targeted by cybercriminals. No plan is 100% secure, however. About security, Zelle says: There’s also a Pay It Safe webpage that highlights resources and tips for safe payments, understanding fraud and scams, and more.

Send Money With Zelle: Getting Started

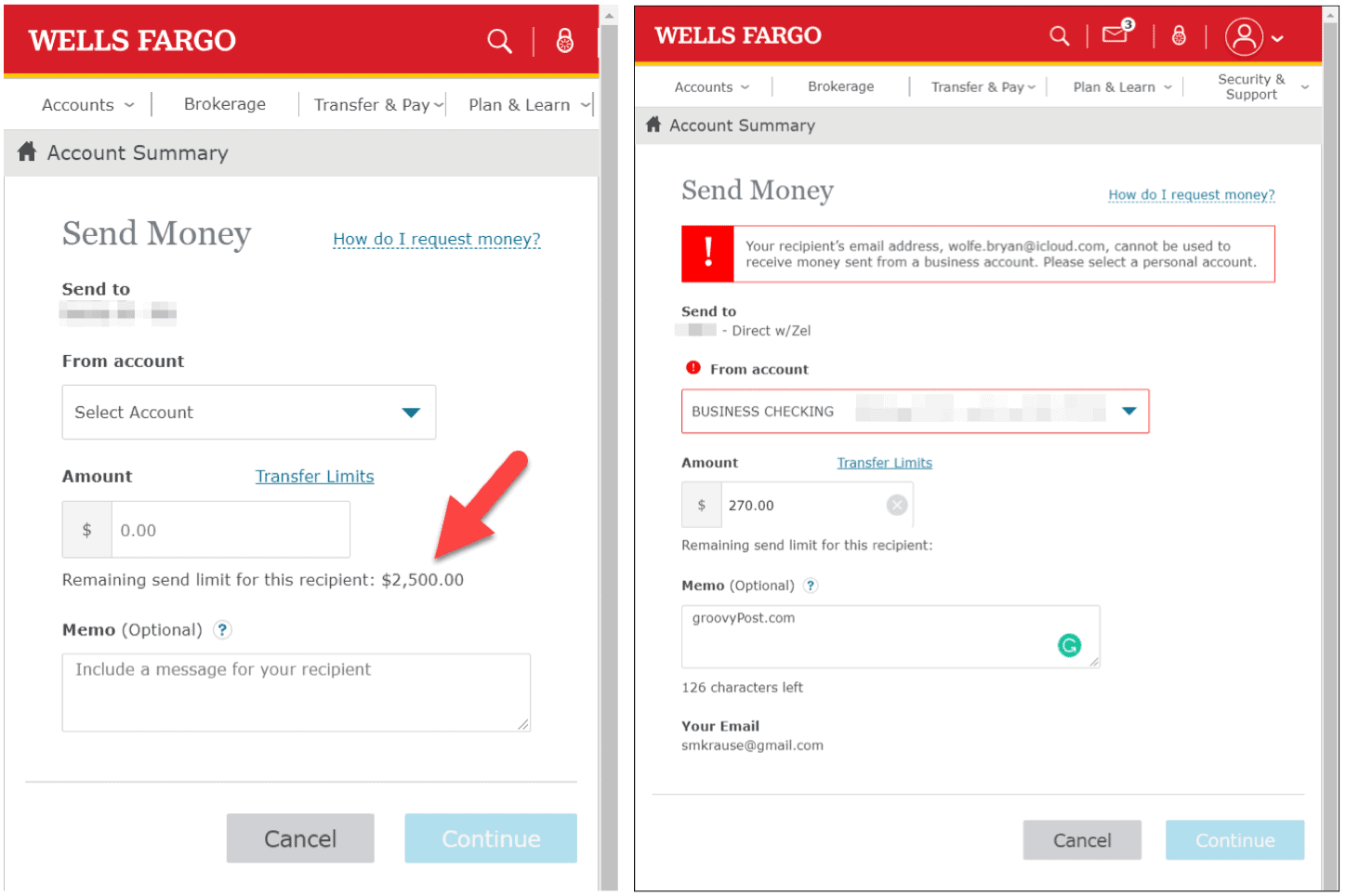

As previously noted, you can use Zelle through a participating institution or the Zelle app. For example, I’ve used it countless times with Wellsfargo to instantly send and receive cash using both the Wellsfargo App and its website.

Send Cash Through Your Bank

The fastest way to get started with Zelle is to log into your banking website or app, then find the Zelle link. The list of banks and credit unions that support Zelle continues to grow. Once you register your banking account with Zelle, you’re ready to go. Although some banks differ, you can send money through Zelle by following these steps:

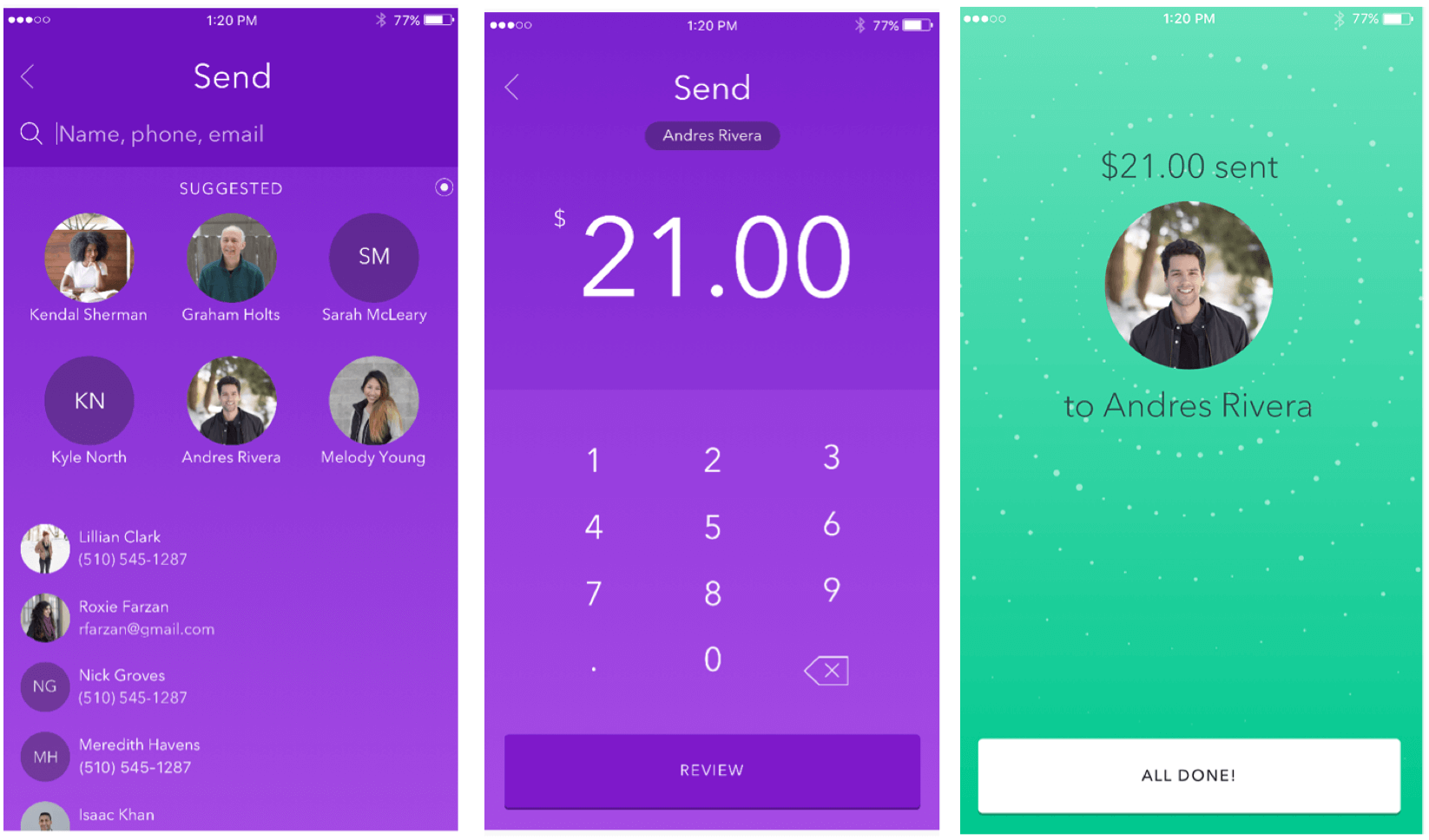

Send Cash Through the Zelle App

If your bank or credit union doesn’t yet partner with Zelle, you can still use the service by downloading the Zelle app for iOS or Android. You can enroll for a new Zelle account with your mobile number and Visa or Mastercard debit card. Once registered, you can immediately send money through the Zelle app by following these steps:

Sending Limits

When getting started with Zelle, your bank will set daily sending limits (for your protection) to new recipients you are sending cash to. MyBankTracker keeps track of daily and monthly Zelle limits at top U.S. banks. They tend to vary significantly from bank to bank. Additionally, limits tend to get adjusted over time. For example, at WellsFargo, new recipients can only be sent $500 per day. However, by sending cash multiple times to the same recipient, the daily limit increases to $2500.

Can I use Zelle with my Business Account?

Send Money With Zelle: Pros and Cons

The Zelle person-to-person payment service has a lot going for it, beginning with its cost. It’s free to send and receive money. However, you are limited to using savings, checking, and debit card accounts. Speed is another benefit. Since the participating banks work together, the transfer process is much faster than other services like Venmo. On the negative side, make sure you’re sending a payment to the right person. Otherwise, you’re probably out of luck. Banks typically only consider unauthorized transactions fraudulent; therefore, make sure the phone number or email is correct before pushing the send button.

Pros

Free to send and receive.Speedy delivery when you use a member bank.Built directly into most bank’s and credit union’s mobile apps.Great way to transfer funds between your own accounts at different banks.

Cons

It’s on you if you send a payment to the wrong person.Not a great solution if you need to transfer/send large amounts of funds.

Zelle provides a quick and easy way to send and receive money through the web or mobile devices. Anyone with an eligible U.S.-based bank account using their email address or U.S. mobile phone number can use Zelle — even if their bank does not. Get started with Zelle today!

![]()